Time to Change the Start-Up-Venture Capital Funding Narrative

Time to Change the Start-Up-Venture Capital Funding Narrative

Recommended

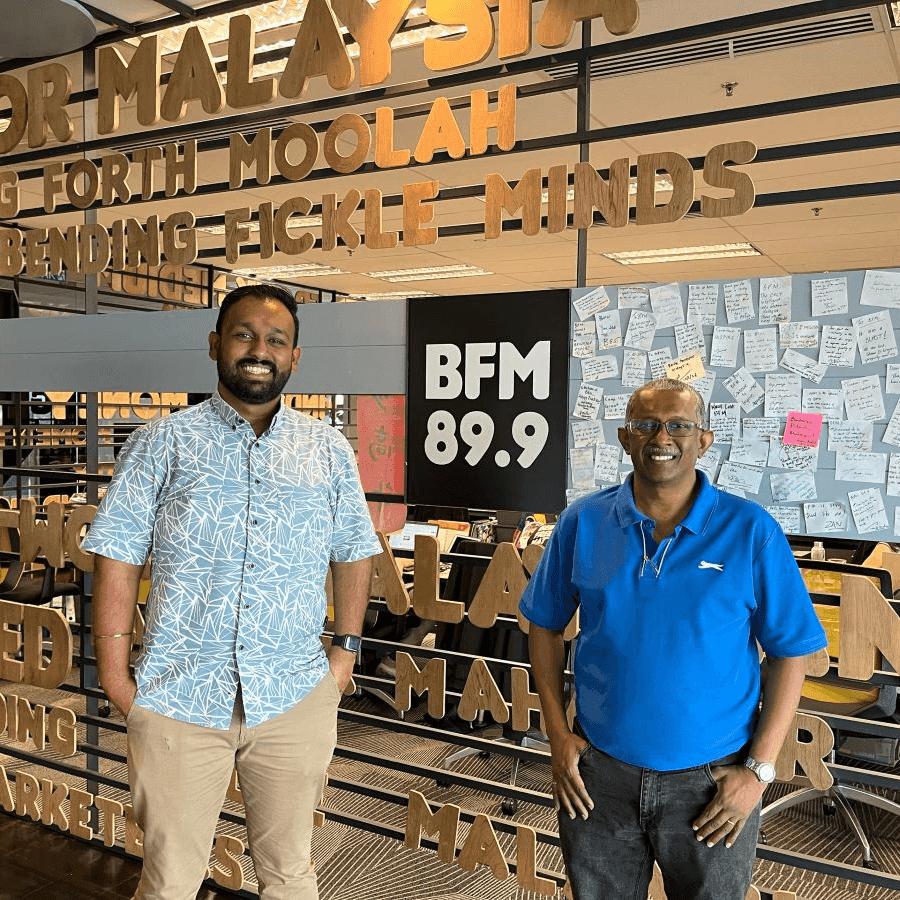

Guest: Dr Dr Sivapalan Vivekarajah (Senior Partner & Co-Founder), ScaleUp Malaysia Accelerator

Today Enterprise Explores 5 Ideas to shakeup the Start-Up and funding here in Malaysia and Southeast Asia with Dr Sivapalan Vivekarajah, Senior Partner & Co-Founder, ScaleUp Malaysia Accelerator.

Post-pandemic, startups now find themselves navigating through an uncertain environment courtesy of the higher interest rate environment, funding winter, lower valuations, and even down rounds. On top of that, the struggle to raise funds has caused many companies to resort to cost-cutting measures, including layoffs.

In a recent article in The Edge, Doc Siva notes that this downturn has changed investor perspectives and start-up founders will need a mindset change to succeed over the next few years.

Tapping into his 25 years of experience in the Malaysia tech ecosystem, as well as his startup investing history having made 52 investments in total as an angel investor but also through ScaleUp Accelerator, he proposes 5 ideas to change up the narrative and move away from the Silicon Valley growth-driven model that has been the de-facto way of doing business in the scene.

In this conversation we will get into and breakdown each of the 5 ideas in more detail, but to give you a sense of what’s coming ahead, here are the 5 headlines that he used in his article:

1. Build an enduring business

2. Change the growth model

3. Limit the amount raised

4. Spend time on the business, not fundraising

5. For enduring businesses, an IPO is a better ‘exit’

Presenter: Roshan Kanesan

Producer: Kishan Sivaswamy

Share:

Recommended

Recent episodes

0

Latest stories

BFM 89.9

The Business Station

Copyright © 2025 BFM Media Sdn. Bhd. 200601017962. All rights reserved

Copyright © 2025 BFM Media Sdn. Bhd. 200601017962. All rights reserved