BFM 89.9

The Business Station

Copyright © 2025 BFM Media Sdn. Bhd. 200601017962. All rights reserved

Copyright © 2025 BFM Media Sdn. Bhd. 200601017962. All rights reserved

BFM 89.9

The Business Station

Copyright © 2025 BFM Media Sdn. Bhd. 200601017962. All rights reserved

Copyright © 2025 BFM Media Sdn. Bhd. 200601017962. All rights reserved

5 Transfer Pricing Lessons You Can’t Ignore in 2025

Recommended

44 mins

50 mins

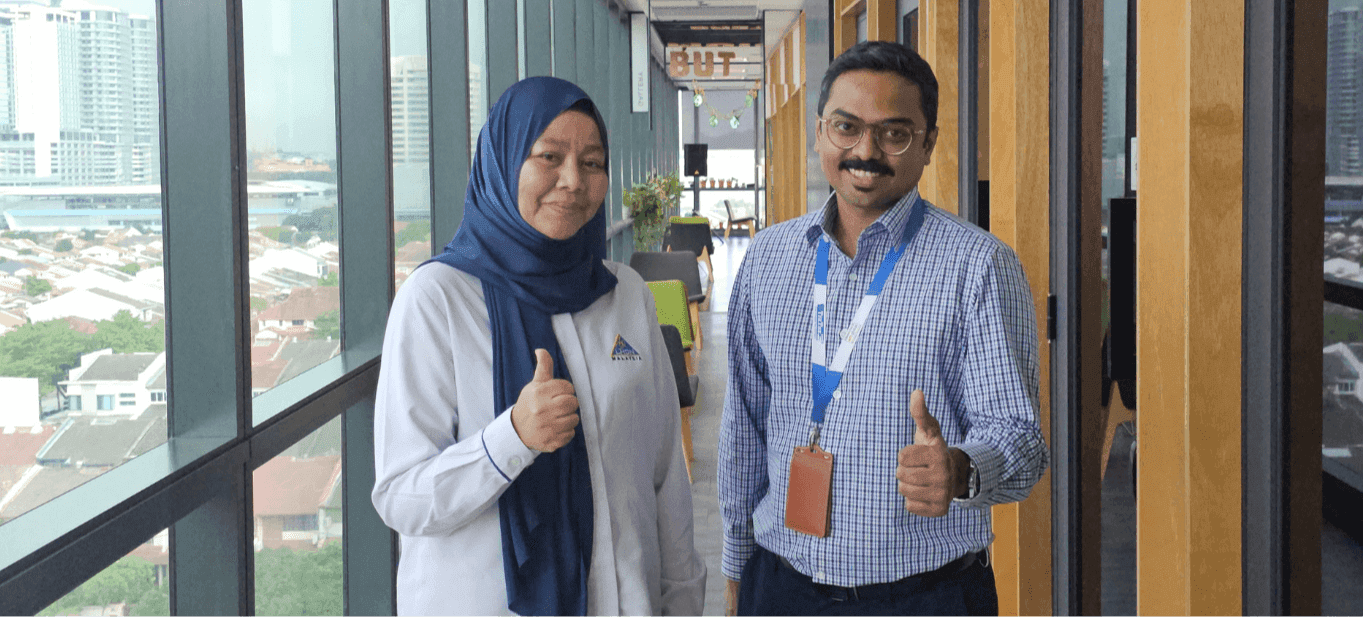

Guest: Suhani Binti Anuar (Director), Transfer Pricing Division at LHDN | Thenesh Kannaa (Executive Director), Tratax

In this episode of P&L, we spotlight the 5 biggest transfer pricing mistakes businesses risk making under Malaysia’s 2024 updates. Joining us are Suhani Binti Anuar, Director of the Transfer Pricing Division at LHDN, and Thenesh Kannaa, Executive Director at Tratax, to break down what you need to know to stay compliant and avoid costly penalties.

We cover expanded exemptions for small businesses, how to correctly apply low-value-added service (LVAS) simplifications, the importance of complying with the arm’s length principle even when exempt, and why businesses must not overlook transfer pricing implications in intragroup financing and restructuring. We also explore the new RM20,000–RM100,000 weekly penalties for delayed documentation and how tariff shifts can trigger unexpected transfer pricing risks.

Most importantly, Suhani and Thenesh explain why transfer pricing must be embedded into your business decision-making, not treated as just another annual compliance checklist. Essential listening for CFOs, business owners, and tax advisors navigating Malaysia’s evolving tax landscape.

Presenter: Roshan Kanesan

Producer: Roshan Kanesan

Share:

Recommended

Recent episodes

0

Latest stories