BFM 89.9

The Business Station

Copyright © 2025 BFM Media Sdn. Bhd. 200601017962. All rights reserved

Copyright © 2025 BFM Media Sdn. Bhd. 200601017962. All rights reserved

BFM 89.9

The Business Station

Copyright © 2025 BFM Media Sdn. Bhd. 200601017962. All rights reserved

Copyright © 2025 BFM Media Sdn. Bhd. 200601017962. All rights reserved

ASEAN Tech Needs 15 Year VC Cycles, Not 10?

ASEAN Tech Needs 15 Year VC Cycles, Not 10?

Recommended

1 hr 22 mins

42 mins

47 mins

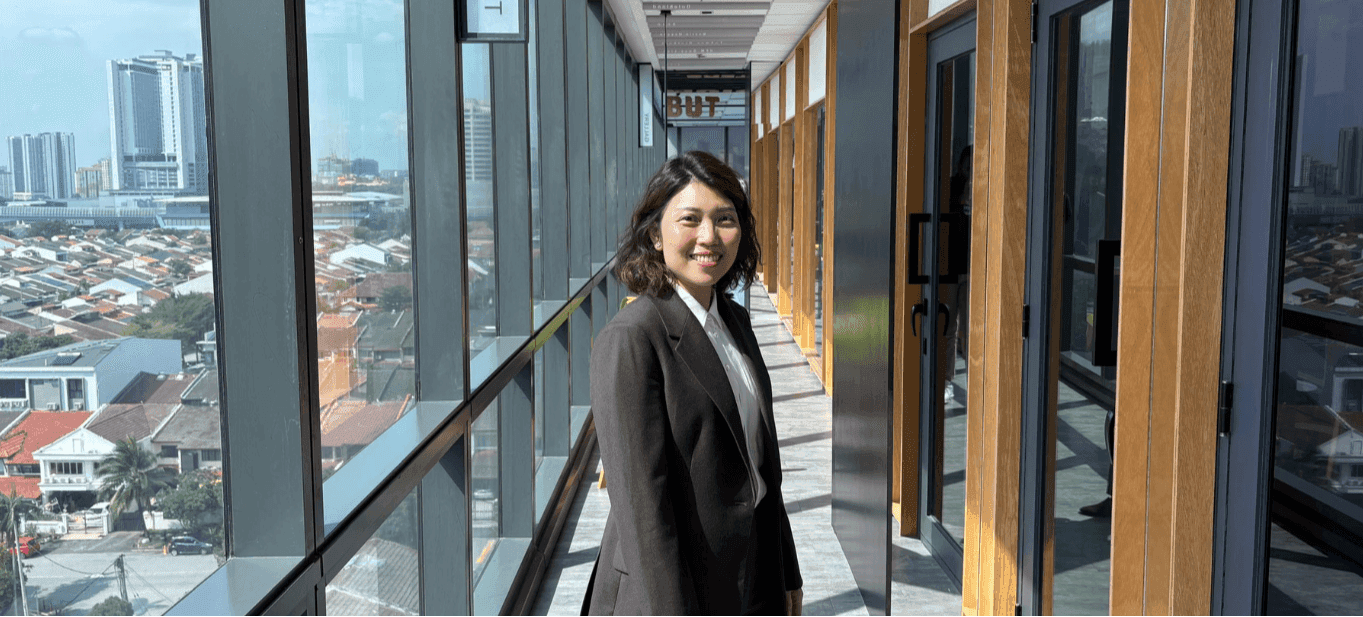

Guest: Jeep Kline (Founder & Managing Partner), Raisewell Ventures

Why is this Silicon Valley VC bullish on Southeast Asian tech companies, despite faltering IPOs, blowups, and a scarcity of exits?

Launched in 2024, Raisewell Ventures has raised over $35 million to invest in AI, climate, and manufacturing tech, with a longer term aim to cross-pollinate between Silicon Valley and Southeast Asia.

With 14 deals already completed, Founder and Managing Partner Jeep Kline joins us to share her unique strategy. She explains why she's bullish on this region, why deep tech requires 12-15 year "patient capital", and much more.

We discuss:

Why SEA tech needs to cross-pollinate with Silicon Valley.

Why deep tech and "hard tech" require 12-15 year "patient capital".

The 3 pillars (academia, capital, government) needed to build a tech economy.

A new approach to solving Southeast Asia's chronic exit problem.

This episode of Open For Business is powered by PETRONAS SmartPay, the simpler and better solution for all your business needs.

Presenter: Roshan Kanesan

Producer: Roshan Kanesan

Share:

Recommended

Recent episodes

0

Latest stories