E-Invoicing Anxiety? Understanding SME Concerns and Path Ahead

E-Invoicing Anxiety? Understanding SME Concerns and Path Ahead

Recommended

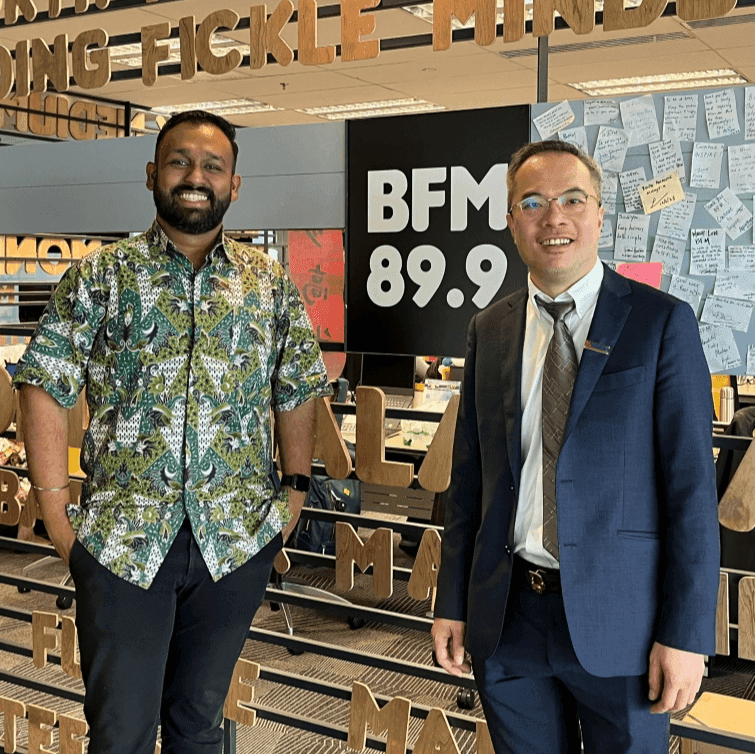

Guest: Datuk William Ng (Chairman), Small and Medium Enterprises Association (SAMENTA)

With the phased implementation of the mandatory e-invoicing starting in 3 weeks time, today we check-in with Datuk William Ng, President of the Small and Medium Enterprises Association (SAMENTA) about how businesses, in particular SMEs, are feeling about the incoming regime. We get into how businesses are coping to meet the requirements, their key concerns and friction points, and what else can or should be done to support SMEs in the push to e-invoicing.

To recap, from August 1st, taxpayers with annual turnover exceeding RM100mil are required to implement e-invoicing. Following this, businesses with revenue between RM25 million to RM100 million must implement e-invoicing by January 1st 2025, with all other businesses, except some MSMEs, having until July 1st 2025 to adopt e-invoicing. The exemption applies to Micro, small and medium enterprises (MSMEs) earning less than RM150,000 annually as announced last week by Finance Minister II, Datuk Seri Amir Hamzah Azizan.

Presenter: Roshan Kanesan

Producer: Kishan Sivaswamy

Share:

Recommended

Recent episodes

0

Latest stories

BFM 89.9

The Business Station

Copyright © 2025 BFM Media Sdn. Bhd. 200601017962. All rights reserved

Copyright © 2025 BFM Media Sdn. Bhd. 200601017962. All rights reserved