Regulating BNPL: Malaysia’s Consumer Credit Bill

Regulating BNPL: Malaysia’s Consumer Credit Bill

Recommended

21 mins

10 mins

12 mins

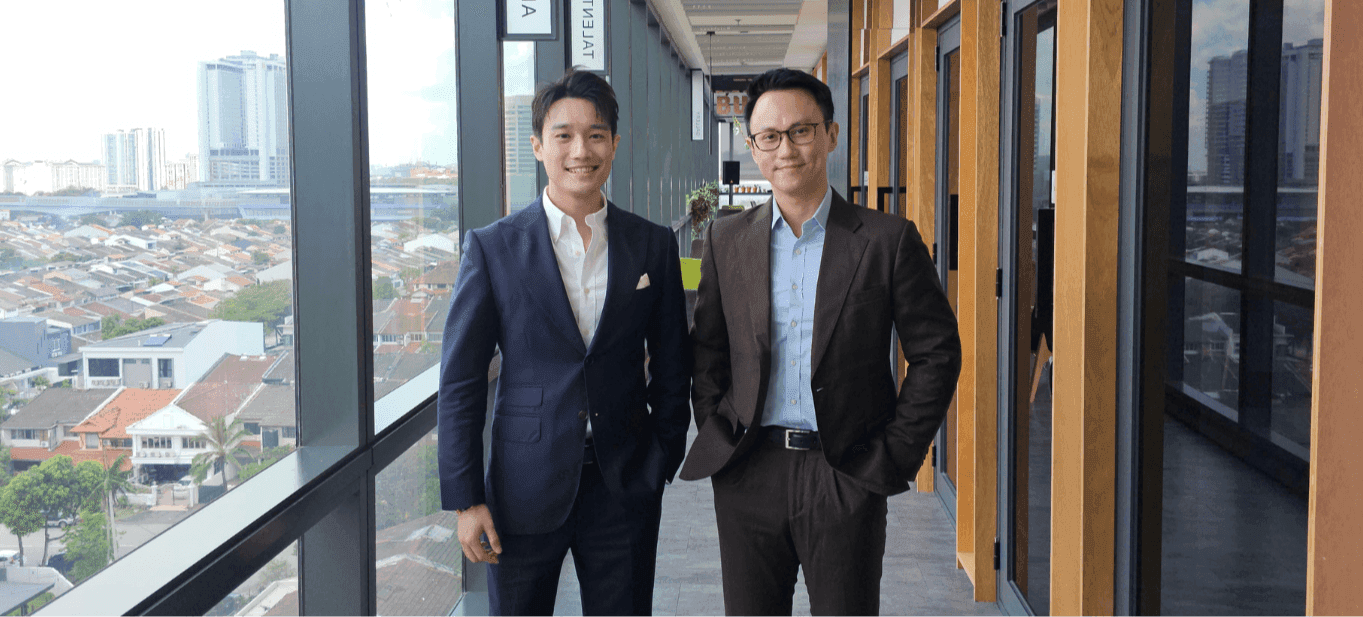

Guest: Ong Johnson (Partner and Head, Technology Practice Group), Lo Khai Yi (Partner and Co-Head, Technology Practice Group), Halim Hong & Quek

From Buy Now, Pay Later (BNPL) schemes to equipment leasing, Malaysia’s booming non-bank credit ecosystem is on the verge of a regulatory overhaul. Enter the Consumer Credit Bill 2025 — a key piece of legislation designed to improve consumer protection, clamp down on unlicensed operators, and bring order to an increasingly fragmented sector.

But is the bill striking the right balance? Or could it end up stifling innovation and pushing smaller fintech players out of the market?

In this episode of Enterprise Explores, we speak with Lo Khai Yi and Ong Johnson, partners at Halim Hong & Quek, to unpack what the bill means for businesses and consumers. They explore everything from the rise of the Consumer Credit Commission (CCC) to the legal and operational challenges the bill introduces, including licensing hurdles, overlapping regulations, hefty penalties, and the murky future for fintech-driven credit products.

We also discuss whether the bill risks regulatory overreach and how Malaysia can regulate responsibly without sacrificing growth and innovation in the credit space.

Presenter: Roshan Kanesan

Producer: Richard Bradbury

Share:

Recommended

Recent episodes

0

Latest stories

BFM 89.9

The Business Station

Copyright © 2025 BFM Media Sdn. Bhd. 200601017962. All rights reserved

Copyright © 2025 BFM Media Sdn. Bhd. 200601017962. All rights reserved