BFM 89.9

The Business Station

Copyright © 2025 BFM Media Sdn. Bhd. 200601017962. All rights reserved

Copyright © 2025 BFM Media Sdn. Bhd. 200601017962. All rights reserved

BFM 89.9

The Business Station

Copyright © 2025 BFM Media Sdn. Bhd. 200601017962. All rights reserved

Copyright © 2025 BFM Media Sdn. Bhd. 200601017962. All rights reserved

Recommended

47 mins

32 mins

29 mins

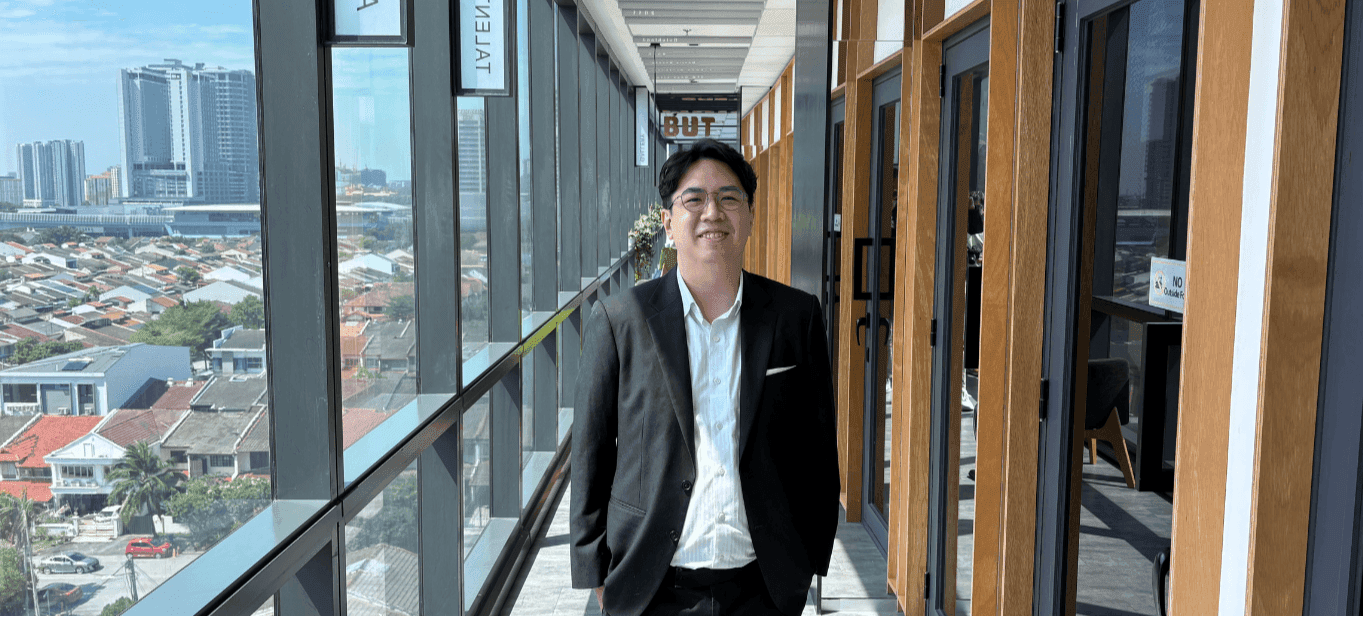

Guest: David Lim (Founding Partner), TSF Law

For many founders, an M&A deal feels like the ultimate exit. But what starts as a pot of gold often turns into a minefield of brutal due diligence, hidden liabilities, and founder infighting. In fact, a significant number of promising deals fall apart before even reaching the finish line.

Lawyer David Lim of TSF Law joins us to unpack the 5 key reasons why these deals get messy. He explains the principle of "caveat emptor" (buyer beware), the long-term liabilities that can follow a founder for years, and the critical mistake of founders getting too involved in the deal-making process.

We discuss:

The "brutality" of due diligence and why founders must be prepared.

Why the deal doesn't end at signing: understanding warranties and clawbacks.

The risk of founders getting too involved and letting the core business suffer.

Why hiring generalist advisors for a "friendly price" is a costly mistake.

The importance of a "sell-side health check" before you even talk to a buyer.

For any founder or business owner considering an exit, a merger, or a significant fundraising round, this is an essential dive into navigating the process and protecting your interests.

Presenter: Roshan Kanesan

Producer: Roshan Kanesan

Share:

Recommended

Recent episodes

0

Latest stories