BFM 89.9

The Business Station

Copyright © 2025 BFM Media Sdn. Bhd. 200601017962. All rights reserved

Copyright © 2025 BFM Media Sdn. Bhd. 200601017962. All rights reserved

BFM 89.9

The Business Station

Copyright © 2025 BFM Media Sdn. Bhd. 200601017962. All rights reserved

Copyright © 2025 BFM Media Sdn. Bhd. 200601017962. All rights reserved

Halogen's Crypto Moat? 0 to RM400M AUM in 3 Years

Halogen's Crypto Moat? 0 to RM400M AUM in 3 Years

Recommended

25 mins

34 mins

45 mins

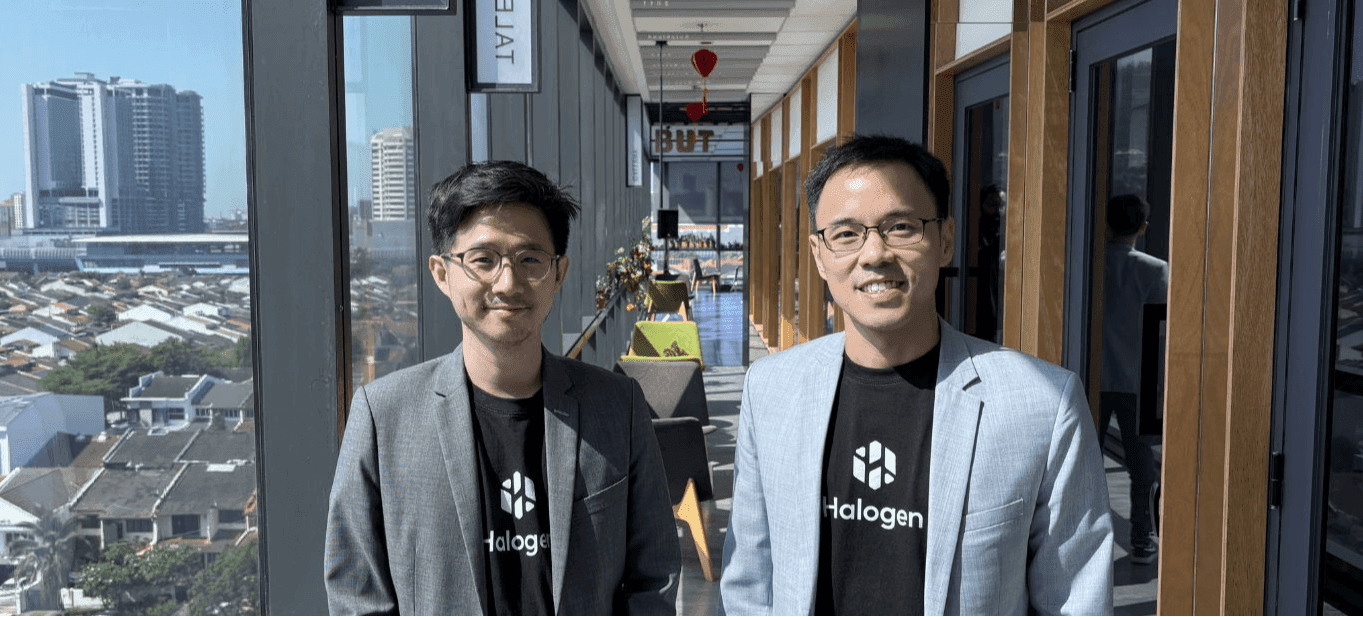

Guest: Hann Liew (Co-Founder), Lucas Ooi (Co-Founder), Halogen Capital

Is it possible to reduce an investment portfolio's risk by adding a highly volatile asset like Bitcoin? Halogen Capital Co-Founders Hann Liew and Lucas Ooi certainly think so.

While the investment thesis might be a point of debate, the business traction is undeniable. Founded in 2023, Halogen has grown from zero to RM400 million in AUM, with institutions making up 70%-80% of that figure.

Adding fuel to this momentum, they closed a RM13.3 million funding round in December led by Kenanga Private Equity, alongside 500 Global.

While headlines focus on Bitcoin's price action, Halogen has quietly built a moat by doing the unglamorous work: manufacturing familiar financial products (like Unit Trusts) around complex digital assets. This strategy has allowed them to bypass retail speculation and tap into the deep pockets of banks, insurers, and high-net-worth individuals.

In this deep dive, we move beyond the hype to understand the infrastructure of modern fund management. Hann and Lucas explain why they believe that major banks can't simply "copy-paste" their strategy, why they built their own cloud-native back-office system, and how they plan to use their recent RM13.3 million funding to tokenise Real World Assets (RWA) like bonds and real estate.

We discuss:

The Trump Effect & Mainstream Adoption: How the US political shift has forced research houses to take crypto seriously, moving it from a niche gamble to a top-tier alternative asset.

The Portfolio Thesis: Why they believe that adding a volatile asset like Bitcoin to a traditional 60/40 portfolio can actually reduce overall risk due to low correlation.

The "Infrastructure Moat": Why major institutions can't easily copy-paste Halogen's strategy, and the complexities of building a self-custody, compliance-heavy back-office system.

Manufacturing Trust: How Halogen bridged the gap between "wild west" crypto and conservative banking compliance by wrapping digital assets in regulated wholesale fund structures.

Beyond Bitcoin: The roadmap for turning bonds, sukuk, and real estate into digital tokens to improve market access and liquidity for investors.

The Tech-Agnostic Future: Halogen’s long-term vision to export Sharia-compliant crypto products globally and evolve into a fund manager that can handle any asset class, on or off-chain.

Presenter: Roshan Kanesan

Producer: Roshan Kanesan

Share:

Recommended

Recent episodes

0

Latest stories